Event exactly what you ought to get property will likely be a daunting task. And that’s simply in terms of the papers. Acquiring the financials in order is one thing some other entirely.

Whenever you are buying your very first domestic, there are a lot of hoops so you’re able to dive as a result of, maybe not minimum of of which is getting minimal down payment.

With every home loan which is considering, the borrowed funds matter was contingent on down-payment. Of many creditors and you can financial advisors suggest a great 20% downpayment. The higher their deposit, then reduce your rate of interest will usually feel.

The difficult issue was placing you to definitely down-payment together. Should this be very first family and you are trying to cut and save getting a deposit, following buying property might feel like a faraway dream.

You’ll find various ways to have that advance payment currency, specific shortcuts you to prevent the usual protecting ten% of the income for many years before you buy property guidance. Just what are it?

A loan from a family member

That loan out-of a family member was theoretically a type of borrowing from the bank, however, instead of all of the legal strings connected with it. Fundamentally, when the a big cousin or grandparent often feet the bill having the down-payment, then you’re regarding clear, relatively speaking the.

You’ll have to disclose into standard bank where in actuality the currency originated from. Yet not, very finance companies and you can credit unions cannot balk at family relations loaning currency to have down costs. It is a fairly common practice.

Discover benefits and drawbacks compared to that. The newest expert is that you can rating financing on house. Brand new cons try step one) there might be taxation effects for searching a gift of these dimensions and 2) it has been mentioned that the new worst visitors to need funds from are see this site your family. As to why? Since it transform the family active and can harm historical relationships. Its one thing to imagine.

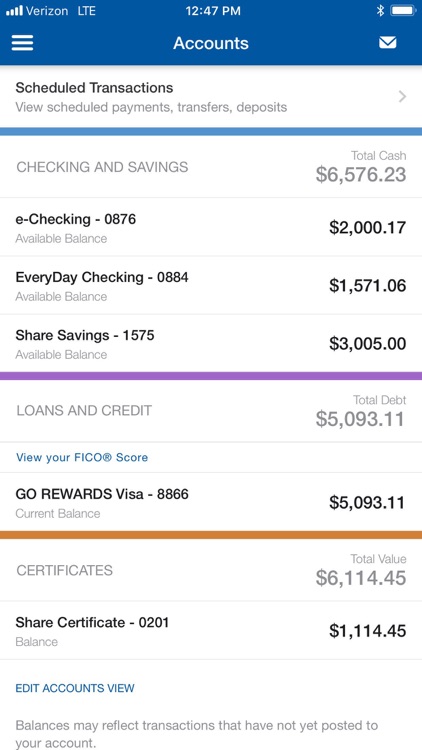

Regarding a personal loan, one may use it as a down-payment towards a family. But not, it may be very hard to get a personal bank loan into the extent needed to create a great 20% downpayment. Along with, if you’re getting a credit line with the deposit, then the ramifications of the line of credit are going to affect what you can do to obtain the financial.

In the event the financial qualifications are computed, the borrowed funds professional will on what a good costs and possessions you’ve got. If however you possess a massive unsecured loan for 20% of property value the home, that could be a warning sign with the specialist.

That financial specialist would have to decide whether you could potentially pay from both fund and you will, or even, which one you would default towards the. If your specialist thinks you’ll default toward home loan, then you definitely would not get approved.

But not, signature loans are often made use of since the off money to possess small orders. Which is commonly correct on the acquisition of mobile land, where total cost (thin down payment) actually high.

One of the ways you could potentially borrow money making a deposit is by using a home security financing. Of course, meaning you have a property that you maybe not just individual, but i have collateral during the. However,, if you see such standards, then you may power you to definitely collateral to find a down payment to possess possibly a new household otherwise a second household – perhaps accommodations possessions or good cabin.

Summary

No matter what your role, you are going to have to make sure to make the monthly obligations, financing payments, (and closing costs) and do everything at the same time. Try to afford the credit line in inclusion on the mortgage.