- Builder Approval: The fresh new debtor must work on a Va-approved creator otherwise builder to do the project.

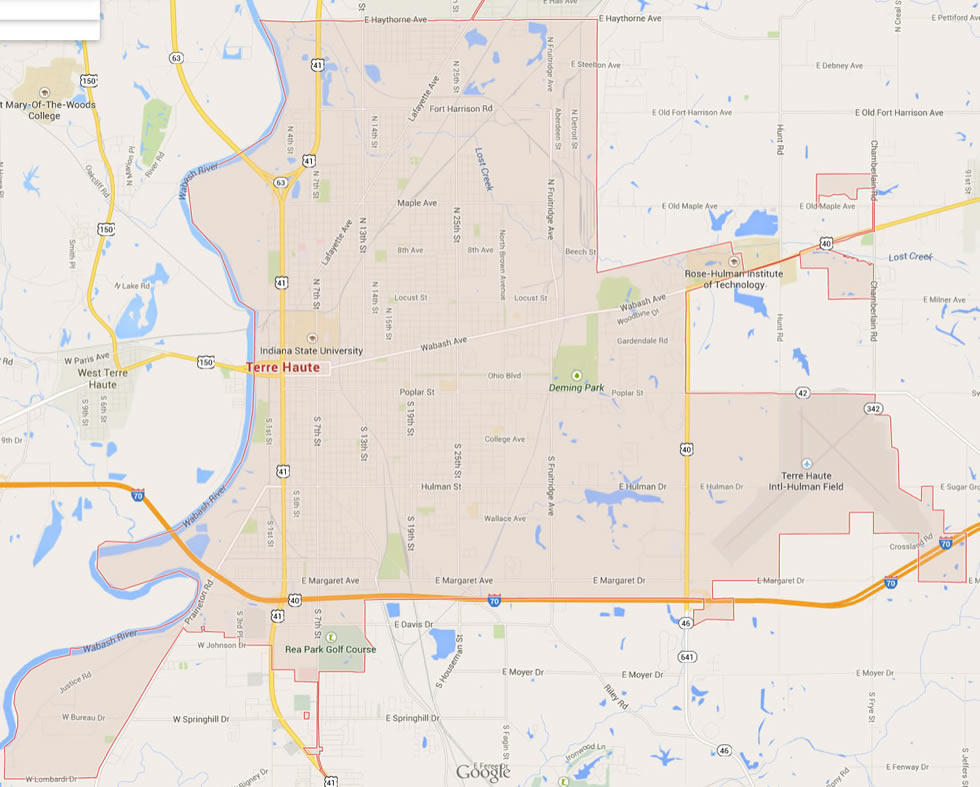

- Financing Limitations: New debtor must adhere to the newest VA’s financing limits, which are different of the location as they are in accordance with the cost of design.

- Downpayment: The fresh borrower isn’t needed and make a deposit on the the mortgage, nonetheless may be needed to invest a framework serious money deposit to the builder.

- Creditworthiness: The fresh debtor need meet with the Virtual assistant credit and you will money criteria in order to be eligible for the mortgage.

Of the fulfilling these criteria, individuals will enjoy the benefits and you may defenses that come with Va money, along with aggressive interest levels, no advance payment requirements, and a lot more.

Criteria to possess Borrowers

Which generally speaking is sold with having a particular period of service or being an enduring spouse out-of an experienced. You’ll also have to render debt recommendations, https://paydayloanalabama.com/hayneville/ as well as your credit rating and you will income, to decide how much cash you could borrow. These standards are specifically essential when searching for a lender.

When you shop around for good Va authoritative bank, there are several factors to consider to make sure you pick a lender you to ideal suits you. Earliest, you ought to see a lender who’s knowledge of Va money and you can knows exclusive criteria and you may advantages of such funds. You can request guidelines from other veterans or perform a little research on the internet to find reliable loan providers near you. Second, you really need to examine interest rates and you will charges off numerous lenders to help you get the least expensive option. Be sure to inquire for each and every financial about their closing costs, mortgage origination fees, or any other charge. Third, you should consider the latest lender’s customer support and you will telecommunications concept. We wish to work with a lender that is responsive and you can easy to run throughout the financing process particularly when carrying out a setup once the timelines will often move. Fundamentally, it’s also possible to browse the lender’s evaluations and critiques online observe what other customers have to say regarding their experience because once you get become it will be tough to move to a different acknowledged bank. If you take the time to look around and you will contrast lenders, you’ll find a beneficial Virtual assistant certified lender that you feel safe dealing with and you can who will make it easier to reach finally your homeownership requires.

Criteria to have Designers

Developers should be authorized by the Va and must possess feel which have Virtual assistant structure funds. They want to likewise have a valid license, liability insurance, and you may a good reputation in the community. Looking a creator competent to create that have a great Virtual assistant design mortgage needs some research and due diligence on the part of the fresh debtor. One option is to search for Virtual assistant-acknowledged builders from the VA’s web site or of the calling a location Virtual assistant workplace. New Virtual assistant retains a listing of designers who were recognized to work alongside Va build fund, which might be a beneficial place to begin looking for an effective licensed creator.

Another option is always to ask for recommendations from other veterans or realtors towards you. You can even perform a little research online discover builders just who has expertise in Va loans and you will with a good reputation in the region. When researching possible builders, make sure to find out about its experience with Va financing, the qualifications and you may skills, as well as their records out-of past subscribers. You could need to visit a few of their prior build internet observe what they do firsthand. By taking committed locate a qualified creator, you could potentially ensure that your family build otherwise renovation project was finished punctually, into the budget, in order to their fulfillment.