- Find a mortgage lender: Coping with a mortgage lender that has knowledge of new Virtual assistant mortgage techniques ‘s the 1st step into the securing an effective Va mortgage. Best bank will be able to offer advice connected with the new housing market towards you and you may Va financing conditions, together with Va financing entitlement and the mortgage choice you are qualified to own.

- Get a certification away from Qualifications: After you’ve found your own mortgage lender, it is time to get your Certificate away from Eligibility (COE). This file will tell the lender which you be considered to own a good Va mortgage in addition to count that Va commonly be sure on the financing.

- See a house and indication an agreement: Trying to find a property has become the most pleasing element of the method. By using the recommendations provided by your financial and also the Va, you can focus on an agent to get property you to definitely you really can afford and indication a binding agreement with the knowledge that you have got the newest Va mortgage backing.

- Sign up for a good Virtual assistant loan: Once you have finalized an agreement to https://clickcashadvance.com/installment-loans-mo/houston/ buy your brand new home, try to make an application for the latest Va mortgage that coverage the cost of the house. With many Va loan points, you will not need a down payment, which can only help make homeownership less costly. Attempt to give your own financial towards the suitable documents proving income and economic property and liabilities, like conventional mortgages.

- Intimate for the domestic: Once your financial have canned the appropriate documentation and you have already been approved towards the last mortgage, you will indication new data files and you may get ready to go into your brand new home.

We Work with Armed forces Homebuyers

Griffin Money are satisfied to provide very first-day army home buyers with choices to purchase a special family because of its Virtual assistant gurus. We have the experience to work with you just like the a first-big date military house client, and can help to make the process so much more readable and easier so you’re able to cope with. We know you to definitely to find a house might be an enormous step, and you can moving can result in a lot more stress because you works around the military functions. Hence, i move to alleviate those types of stresses on you and you can all your family members.

Established inside 2013, Griffin Capital is actually a national shop mortgage lender focusing on taking 5-star services so you can the website subscribers

Whether you’re an armed forces very first-big date house visitors otherwise has had property prior to now, your Va positives can deal with money property and you can enabling to attenuate the general price of homeownership. Reach out to Griffin Financial support now and start the entire process of protecting an effective Va financial since an initial-go out customer.

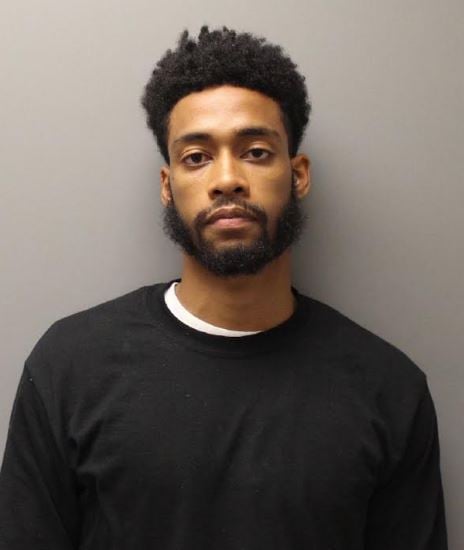

Statement Lyons ‘s the Inventor, Chief executive officer & President from Griffin Investment. Mr. Lyons has 22 numerous years of experience in the loan organization. Lyons is seen as a market leader and you can specialist from inside the real home financing. Lyons might have been featured inside Forbes, Inc., Wall structure Street Journal, HousingWire, and. Because the a member of the borrowed funds Bankers Organization, Lyons can keep up with crucial alterations in brand new industry to send the essential really worth to Griffin’s website subscribers. Less than Lyons’ frontrunners, Griffin Financial support makes the fresh new Inc. 5000 quickest-growing organizations listing five times in a decade operating.

To be eligible for good Virtual assistant loan, consumers must fulfill specific certificates. The first requirements is the fact that the debtor was active-obligations, a great reservist, an experienced, or a qualified surviving mate associated with one of many half a dozen branches of the U.S. army or National Shield. To help you discover Virtual assistant mortgage benefits, the service user otherwise seasoned need certainly to see specific provider go out criteria, as well as their qualification might possibly be affirmed for the a document they located on Virtual assistant called a certification out-of Qualifications (COE).