2. Guaranteed Financing

When you are head fund are from brand new USDA alone, secured finance come from private lenders. The fresh new finance are supported by the brand new USDA, which means that it can step-in and spend if for example the borrower defaults toward loan. The brand new lending requirements having a guaranteed USDA financing was a little looser than the standards having an immediate mortgage.

Consumers must be You.S. residents or qualified low-citizens. They must satisfy earnings requirements, although maximum money invited exceeds on the head financing program. Eligible individuals need to secure only about 115% of your own average money within their town. As with the newest head mortgage system, people who score an ensured USDA financing must are now living in our home as their first quarters.

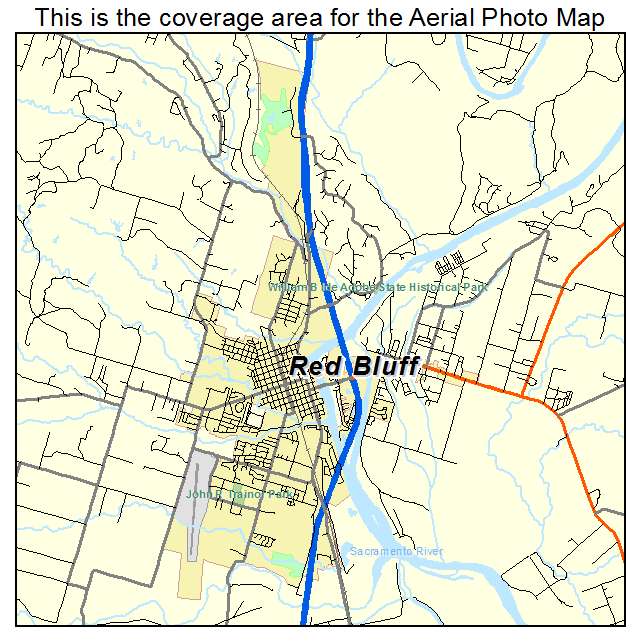

Location criteria is actually a small looser towards secured mortgage program, also. The spot shall be a rural urban area, but some residential district elements including be considered. Prospective borrowers is put the target with the USDA’s eligibility website to verify this qualifies for a home loan.

People who rating a guaranteed mortgage regarding the USDA may 100% funding, definition no downpayment needs. The new USDA will ensure doing ninety% of your amount borrowed. Individuals can use the new finance to buy, build otherwise rehab a qualifying domestic.

3. Home improvement Financing and you can Grants

The brand new USDA loan system also incorporates funds and you may gives that will property owners modernize, boost otherwise fix their homes and you will provides that help older homeowners shell out to eradicate safe practices risks using their residential property. Qualified home owners need certainly loan places Five Points to earn below fifty% of the average earnings due to their urban area.

As of 2021, the utmost amount borrowed is actually $20,one hundred thousand as well as the limit give amount try $7,500. Home owners which be eligible for both a grant and you will a loan is mix her or him, choosing a total of $27,five-hundred. Those who located an excellent USDA do it yourself financing possess two decades to repay it. Due to the fact gives constantly won’t need to become paid, if a citizen deal their house contained in this 36 months of going the newest give, they usually have to pay it right back.

Each other features and you can do it yourself money already been directly from the newest USDA, and you can accessibility may vary predicated on area and season. Eligible people can apply for a financial loan, offer otherwise each other on its regional Outlying Innovation work environment.

4. Rural Construction Site Fund

When you are head and you may guaranteed USDA finance are available to individual consumers, the fresh institution also has mortgage apps to have teams that provides housing so you’re able to lower-money otherwise modest-money homeowners. Eligible organizations include nonprofits and you will federally accepted tribes. Brand new money enjoys identity constraints off 24 months and you may possibly charge a beneficial step 3% rate of interest otherwise an around-field speed, according to the loan method of.

USDA technical guidance provides are supplied in order to nonprofits or federally approved people which help extremely-lowest and you can lowest-money individuals generate their unique house. The fresh new property must be located in qualified components together with individuals who commonly inhabit the brand new homes need to perform very of your work of making brand new properties, with some assistance from the company. The new give money are often used to let generate individuals to the program and to bring supervisory help household, however it cannot be used to financing the genuine construction out of the home.

Whom Need to have good USDA Mortgage?

When you’re to buy a house, you have numerous conclusion while making, like the venue of new home, its proportions as well as facilities. Be sure to find the style of mortgage you get. If or not a good USDA financing is right for you or perhaps not depends towards the a few activities.