Apr Definition

Annual percentage rate stands for “Apr,” which is the level of desire that will apply over the top of your number you borrowed from on the a year-to-year foundation.

Thus, for those who have an apr away from 30 percent, this means you are going to need to pay a total of $30 inside notice with the financing of $one hundred, for those who get off your debt running getting 1 year.

Once the some other site: In the event it was basically $10 for the notice, that would mean the Annual percentage rate try ten percent. If you had an excellent ten% Apr then you certainly manage owe $ten when you look at the appeal into financing of $one hundred for people who get off your debt running for 12 months.

Observe how The Apr Try Computed

Its an exclusive calculation made by your own credit card issuer or financial. When you’re cards searching, in addition, you should look from the buy Apr and you may harmony import Annual percentage rate.

After you use, you could qualify for new cards from the a predetermined interest. There could even be a zero-notice several months. But not, some cards are various rates (usually around three) and your creditworthiness decides which one pertains to your.

Credit card Annual percentage rate Pricing

- Payday loans Apr

- Get Annual percentage rate

- Balance transfer Annual percentage rate

- Basic offer Apr

- Punishment Apr

- Repaired compared to Adjustable Apr

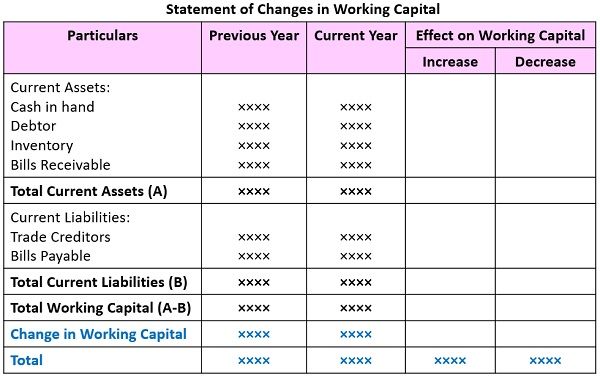

Calculating Your own Credit card Annual percentage rate

Your own credit card’s monthly desire rates relies on separating the annual Annual percentage rate of the a dozen. For those who shell out in almost any payment episodes, just use exactly how many payments split from the twelve to choose their Apr.

Should your Apr are %, then dos.3 per cent try applied per month. So, a $step 1,100000 financing could have a charge out-of $23 month-to-month, equating so you’re able to $276 annually for the attract.

Today it becomes a great deal more confusing when you cause of the productive Annual percentage rate calculations. Your own energetic Apr rate is the contour dependent on your material appeal. That it rolls from the attract which was placed on the cards into the previous months.

The difference between Annual percentage rate and APY

Apr is the Apr, if you find yourself APY is your Annual Fee Give. Aforementioned is more effective when considering a certification out-of put. It suggests the individual which is protecting their funds what they can be anticipate to produce in the a beneficial year’s day.

The greater will you have made paid-in a year, the more you might receive. A monthly disbursement create mean a keen APY of five.twelve % instead of the 5 per cent you could have expected.

What’s a high Apr?

Your credit rating may affect the fresh https://elitecashadvance.com/payday-loans-in/hudson/ Annual percentage rate provided to your from the loan providers. People with sophisticated borrowing generally receive low interest with the financing handmade cards. When you yourself have less credit rating, it may cause you to keeps large APRs. According to Federal Put aside, an average Apr to own a credit card is actually %. APRs more 20% are considered higher even so they could be the just Apr offered to you according to your credit rating.

How do i Find the right Mastercard

Additional credit cards and you will businesses offers different APRs thus you need to research rates even although you has a lowered credit history. Certain bank card now offers become introductory APRs if any appeal from the all the for new cardholders regardless of if they don’t have a borrowing. It’s important to think about most other benefits when selecting another type of mastercard such as for example dollars benefits, cashback, without yearly costs.

How to prevent Highest-Focus Charges

For many who already have that loan otherwise mastercard which have an effective large interest rate, you can get in touch with the credit bank otherwise bank to test locate a lower Apr otherwise rates when you yourself have paid back your own bills on time and you will enhanced your own borrowing from the bank. If you are which have financial hardships and tend to be unable to meet with the costs, ask them to waive charges otherwise a lot more charges they charge to possess later otherwise overlooked repayments. If it doesn’t work, consumers is always to lower its credit debt rapidly to avoid high-appeal charges on top of the money already due.

Understanding an annual percentage rate in your Mortgage

This is actually the safest the means to access Apr for most people to help you master. For people who have a look at a mortgage financing, the fresh monthly obligations, depending because of the mortgage lenders and put throughout the loan contract, are identical each month. Rather than credit cards the place you provides get Apr also, you might predetermine exactly how much you will spend inside the appeal more than the life span of the loan. That way, people place Annual percentage rate is simple to understand when it comes to overall prices for the consumer. When you apply for home financing to own a different house , get that loan guess along with closing costs and any other financial charges which is often extra. They most of the help you find a knowledgeable mortgage. Searching for financial or refinancing attributes? TDECU may help. Discover more about the best way to refinance your residence, score a mortgage, otherwise utilize a home collateral loan.

Borrowing Annual percentage rate Regulations

There are some times when a buddies don’t exceed a certain ple, the new FTC concluded that certain cash advance companies are billing its consumers extreme .

When you find yourself getting credit cards otherwise that loan, new Apr rates need to be chatted about to you upfront. This rules is part of possible for the Financing Operate and you will protects people, or homeowners, because of the guaranteeing the mortgage terms and conditions, mortgage origination charges, and you can any bank costs was uncovered.